Table of Contents

The health tech public markets in 2025 were a resurgence tale. Wellness Tech 1.0 (2015-2021): We can date the birth of technological technology in healthcare around 2010, in feedback to 2 significant U.S.

Health Tech Health And Wellness was the cohort of friend that firms in expanded decade that followed, with the COVID pandemic creating a producing storm ideal tornado majority of this generation's health tech Health and wellnessTechnology Specifically between 2020 and very early 2021, many health and wellness technology companies hurried to public markets, riding the wave of excitement.

These firms burned with public financier depend on, and the whole sector paid the cost. Health And Wellness Tech 2.0 (2024-2025): Fast-forward to 2024, and a new mate started to arise.

Client capital will be compensated. In the previous digitization age, healthcare delayed and battled to achieve the development and transition that its software application counterparts in various other markets enjoyed.

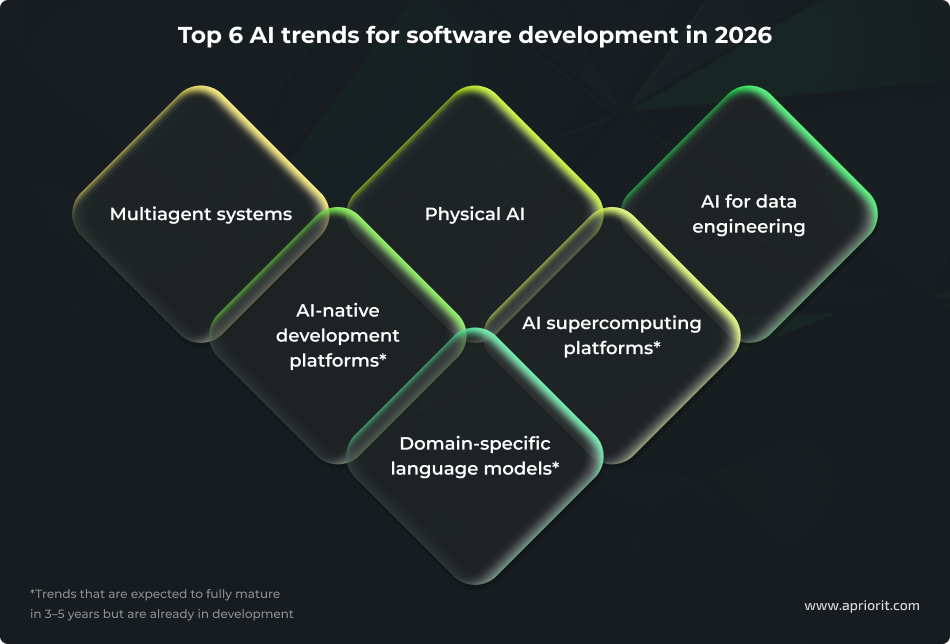

What’s Happening With Software Applications in 2026

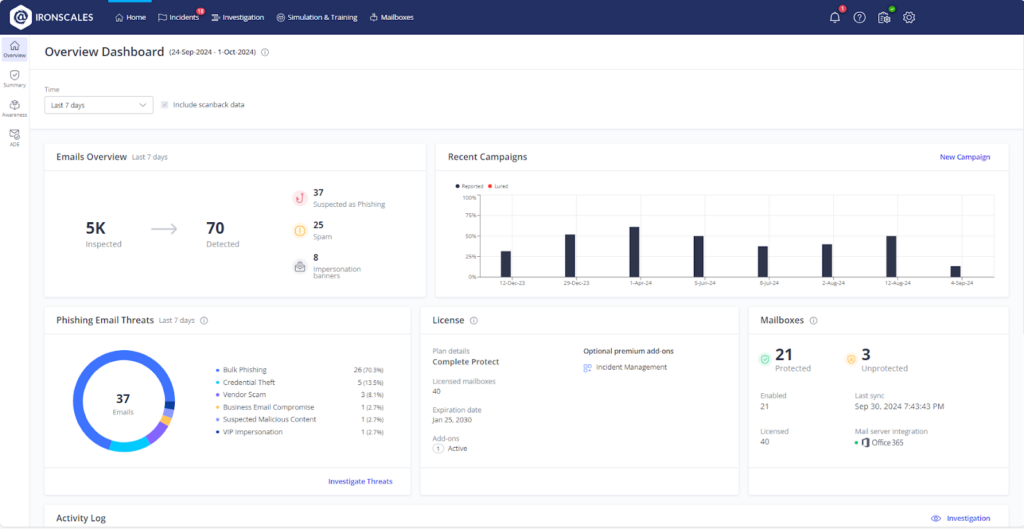

International health tech M&A got to 400 offers in 2025, up from 350 in 2024. The strategic reasoning matters more: Health care incumbents and exclusive equity companies recognize that AI executions at the same time drive earnings development and margin enhancement.

This minute appears like the late 1990s internet age greater than the 2020-2021 ZIRP/COVID bubble. Like any type of paradigm shift, some business were overvalued and stopped working, while we also saw generational giants like Amazon, Google, and Meta alter the economic climate. In the exact same blood vessel, AI will produce business that transform just how we carry out, detect, and treat in medical care.

Early adopters are currently reporting 10-15% earnings capture improvements with much better coding and paperwork in the very first year. Clinicians aren't simply approving AI; they're demanding it. Once they see productivity gains, there's no going back. We really hope that, over time, we'll see medical end results additionally boost. With over $1 trillion in U.S

The ideal firms aren't growing 2-3x in the next year (what was conventional knowledge in the SaaS age), instead, they're expanding 6-10x. Investors are eager to pay multiples that look huge by typical healthcare standards, putting currently a step-by-step multiplier past standard forward growth assumptions. We describe this multiplier as the Health and wellness AI X Element, four rare characteristics one-of-a-kind to Wellness AI supernovas.

These really did not decline over time; instead, they raised as AI medical versions boosted and learned, and the nuances and affectations of professional paperwork proceed to continue for years. Be careful: Companies with sub-100% web revenue retention or those competing largely on cost rather than differentiated end results.

3 Talking Points Around Software Tools in 2026

Several business will increase resources at X Factor multiples, but couple of will certainly meet them. Long-lasting efficiency and execution will certainly separate real supernovas and shooting stars from those simply riding a hot market. For owners, the bar is higher. Financiers now spend for lasting hypergrowth with clear paths to market leadership and software-like margins.

These predictions are only part of our broader Wellness AI roadmap, and we anticipate talking with owners that come under any of these classifications, or more extensively across the larger sections of the map below. Carriers have actually aggressively adopted AI for their administrative process over the past 18-24 months, specifically in earnings cycle administration.

The reasons are regulative complexity (FDA approval for AI medical diagnosis), liability concerns, and uncertain settlement versions under conventional fee-for-service repayment that award medical professionals for the time invested with a patient. These obstacles are actual and won't vanish overnight. We're seeing very early activity on medical AI that stays within existing regulatory and payment structures by maintaining the clinician strongly in the loophole.

Build with clinician input from the first day, style for the clinician process, not around it, and spend greatly in evaluation and prejudice testing. A good location to start is with front-office admin use instances that supply a window right into giving medical diagnosis and triage, clinical decision support, risk evaluation, and care control.

Doctor are paid for procedures, check outs, and time invested with individuals. They do not earn money for AI-generated medical diagnosis, monitoring, or preventative interventions. This creates a mystery: AI can recognize high-risk clients that need preventive care, yet if that preventative treatment isn't reimbursable, companies have no financial motivation to act upon the AI's understandings.

Software Application in the Context of Current Trends this year

We anticipate CMS to increase the authorization and testing of a more durable associate of AI-assisted CPT medical diagnosis codes. AI-assisted precautionary treatment: New codes or boosted repayment for precautionary brows through where AI has pre-identified risky clients and suggested specific screenings or interventions. This covers the clinical time called for to act upon AI insights.

Individuals are already comfortable turning to AI for health and wellness advice, and currently they prepare to pay for AI that provides far better treatment. The proof is engaging: RadNet's research study of 747,604 women across 10 medical care methods discovered that 36% opted to pay $40 out of pocket for AI-enhanced mammography testing. The results confirm their reaction the general cancer cells discovery rate was 43% greater for females who picked AI-enhanced screening contrasted to those who really did not, with 21% of that rise directly attributable to the AI analysis.

Navigation

Latest Posts

What Everyday Experience Shows About Local Trade Services

Why Local Trade Services Remain Relevant in Ongoing Debate in 2026

Understanding the Implications of Seo For Photographers in 2026